Financial Literacy

Quiz by Shannon Gallant

Grade 5

Math (Archived)

Texas Essential Knowledge and Skills (TEKS)

Feel free to use or edit a copy

includes Teacher and Student dashboards

Measure skillsfrom any curriculum

Measure skills

from any curriculum

Tag the questions with any skills you have. Your dashboard will track each student's mastery of each skill.

With a free account, teachers can

- edit the questions

- save a copy for later

- start a class game

- automatically assign follow-up activities based on students’ scores

- assign as homework

- share a link with colleagues

- print as a bubble sheet

14 questions

Show answers

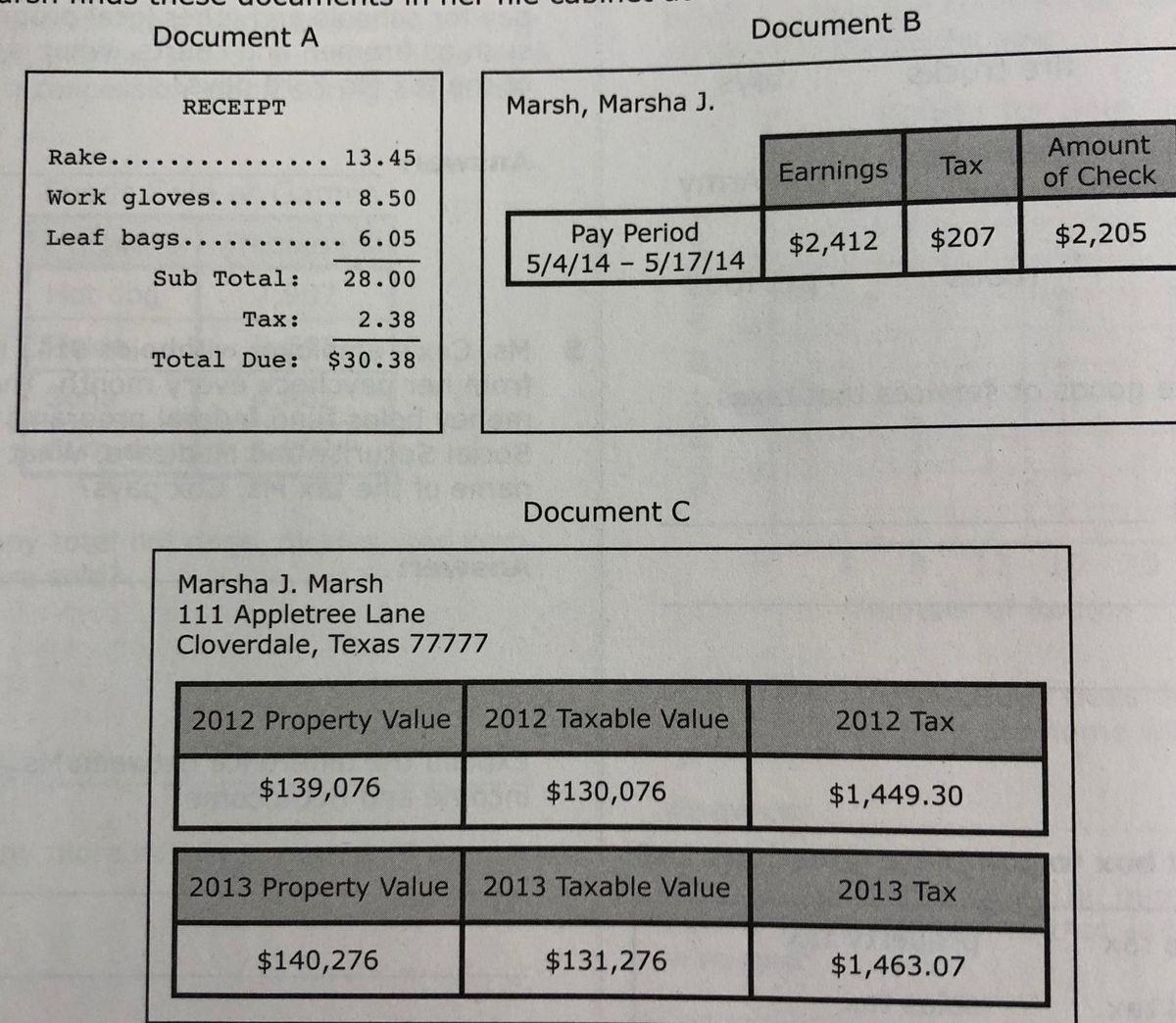

- Q1Ms. Marsh finds these documents in her file cabinet at home. According to the documents, how much property tax did Ms. Marsh pay in 2013?$207$131,276$1.92$1,463.0730s

- Q2How could Ms. Marsh calculate her net income for the year?Multiply $2,205 by the number of pay periodsSubtract $131,276 from $140,276Multiply $2,412 by 52Multiply $207 by the number of pay periods30s

- Q3Which document shows Ms. Marsh's yearly income tax?Document ANot hereDocument CDocument B30s

- Q4Which statement is best supported by information in the documents?Ms. Marsh's gross income is $207 less than her net income for the pay period shown above.Ms. Marsh's property tax is based on the prices of the rake, work gloves, and leaf bags.Ms. Marsh's property tax increased $13.77 from 2012 to 2013Ms. Marsh pays more sales tax than payroll tax.30s

- Q5Mr. Henderson's gross income this month equals his gross income for last month. Mr. Henderson's net income this month is less than his net income last month. Which could explain the change in Mr. Henderson's net income?The local sales tax has increased.His property have decreased.His payroll taxes have increased.His payroll taxes have decreased.30s

- Q6Jerry's grandmother worked in a department store for many years. Now that she has retired, she receives a monthly Social Security check. Jerry's grandmother paid a tax during her working years that helped fund Social Security. Which is the tax?Payroll TaxProperty TaxAll of theseSales Tax30s

- Q7The Cruz family moves to a house with a higher value. As a result, which of the following will probably increase?Their property taxes will decrease.Their property taxes will increase.Their payroll taxes will decrease.Their income taxes will increase.30s

- Q8Lester's gross income increased. As a result which of the following probably happened?His payroll tax decreased.His net income increased.His net income remained the same.His net income decreased.30s

- Q9Micah wants to purchase 2 comic books for $5 each and a set of trading cards for $10. He gives the clerk $20. The clerk said Micah needs money for the tax. Which tax does Micah need to pay?Income taxSales taxProperty taxPayroll tax30s

- Q10Shonde earns $8 per hour working at Taco Town. Her paycheck this week is $199 for 30 hours of work. What amount was withheld from Shonde's paycheck for payroll taxes?$161$41$59$24030s

- Q11Lori's mom buys supplies to clean the kitchen as shown on the receipt. What type of tax does Lori's mom pay at the store?Property taxPayroll taxIncome taxSales tax30s

- Q12For which of the following might this tax be used?A football player's salaryBridge repairsGrocery storesSocial Security30s

- Q13Lori's mom forgot to buy oven cleaner, priced at $4.75. She purchased oven cleaner on a different receipt. About how much tax will Lori's mom pay for the oven cleaner?$0 because Lori's mom already paid the tax when she bought the other items$6.67 because you add $1.92 and $4.75 to find the tax$1.92 because you always add $1.92 for tax$0.39 because tax on $4.75 is less than tax on $23.2630s

- Q14John and Stan work as nurses in different hospitals. Their paycheck stubs for one pay period are shown in the diagram. Based on the paycheck stubs, which is NOT a true statement?John's gross income is $381 less than Stan's gross income for this pay period.John's net income is $123 less than his gross income for this pay period.Stan's net income is $381 more than John's net income for this pay period.Stan's payroll tax is $29 more than John's payroll tax for this pay period.30s