Test - Taxes and How They Effect You

Quiz by Mark Stegall

Feel free to use or edit a copy

includes Teacher and Student dashboards

Measure skillsfrom any curriculum

Measure skills

from any curriculum

Tag the questions with any skills you have. Your dashboard will track each student's mastery of each skill.

With a free account, teachers can

- edit the questions

- save a copy for later

- start a class game

- automatically assign follow-up activities based on students’ scores

- assign as homework

- share a link with colleagues

- print as a bubble sheet

20 questions

Show answers

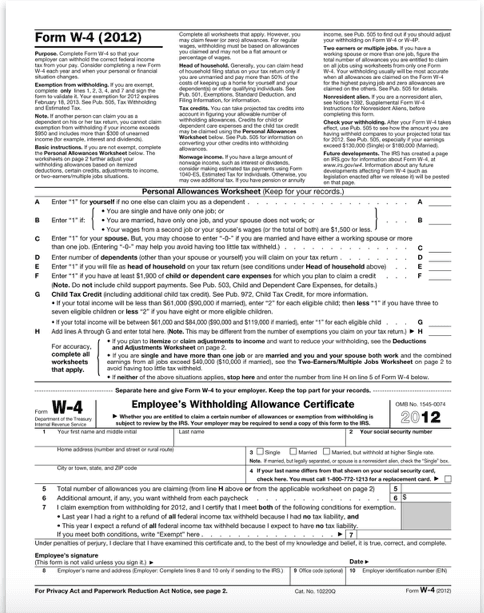

- Q1A married person with two children eligible for the child tax credit, whose spouse does not work, who has @2,200 of Child care expenses and who will earn $49,000 from one job. What should this person enter for the line H on the Personal Allowances Worksheet?1211101330s

- Q2A married person with two children eligible for the child tax credit, whose spouse does not work, who has @2,200 of Child care expenses and who will earn $49,000 from one job. Which box should this person check on Section 3 of the W-4 to receive the lowest withholding rate?SingleMarried, but withhold at the higher single rateMarried30s

- Q3A married person with two children eligible for the child tax credit, whose spouse does not work, who has @2,200 of Child care expenses and who will earn $49,000 from one job. Could this person claim an exemption from withholding on line 7 of the W-4YesNo30s

- Q4What is the penalty for early withdrawal (before age 59 1/2) of money from a traditional IRA?20%15%25%10%30s

- Q5If your salary is $2,000 per month and you contribute 5% to your retirement plan while your employer matches 5%, how much would be added to your retirement plan at the end of the year?$1,200$1,800$600$2,40030s

- Q6Under which circumstance can you withdraw money from an IRA before age 59 1/2 without a penalty?to match an employee contributionto purchase a first hometo invest in government bondsto save for retirment30s

- Q7An example of a short-term goal s saving for a(n) _________both A and Bneither A nor BA. A prom dressB. rock concert next month30s

- Q8Information from a W-4 form is transferred directly to an income tax formfalsetrueTrue or False30s

- Q9A W-2 form must be issued to employees by the end of January.truefalseTrue or False30s

- Q10An IRA can be used as a tax creditfalsetrueTrue or False30s

- Q11A tax credit and a tax deduction are the same thing.falsetrueTrue or False30s

- Q12A flexible spending account for medical expenses is an example of a tax deduction.truefalseTrue or False30s

- Q13The late payment penalty will be charged even if you can show reasonble cause for not paying on timefalsetrueTrue or False30s

- Q14Only the taxpayer can represent his/her case at the U.S. Tax CourtfalsetrueTrue or False30s

- Q15The due date to file an extension is the same as the due date for taxes in that year.truefalseTrue or False30s